Benefits

Benefits

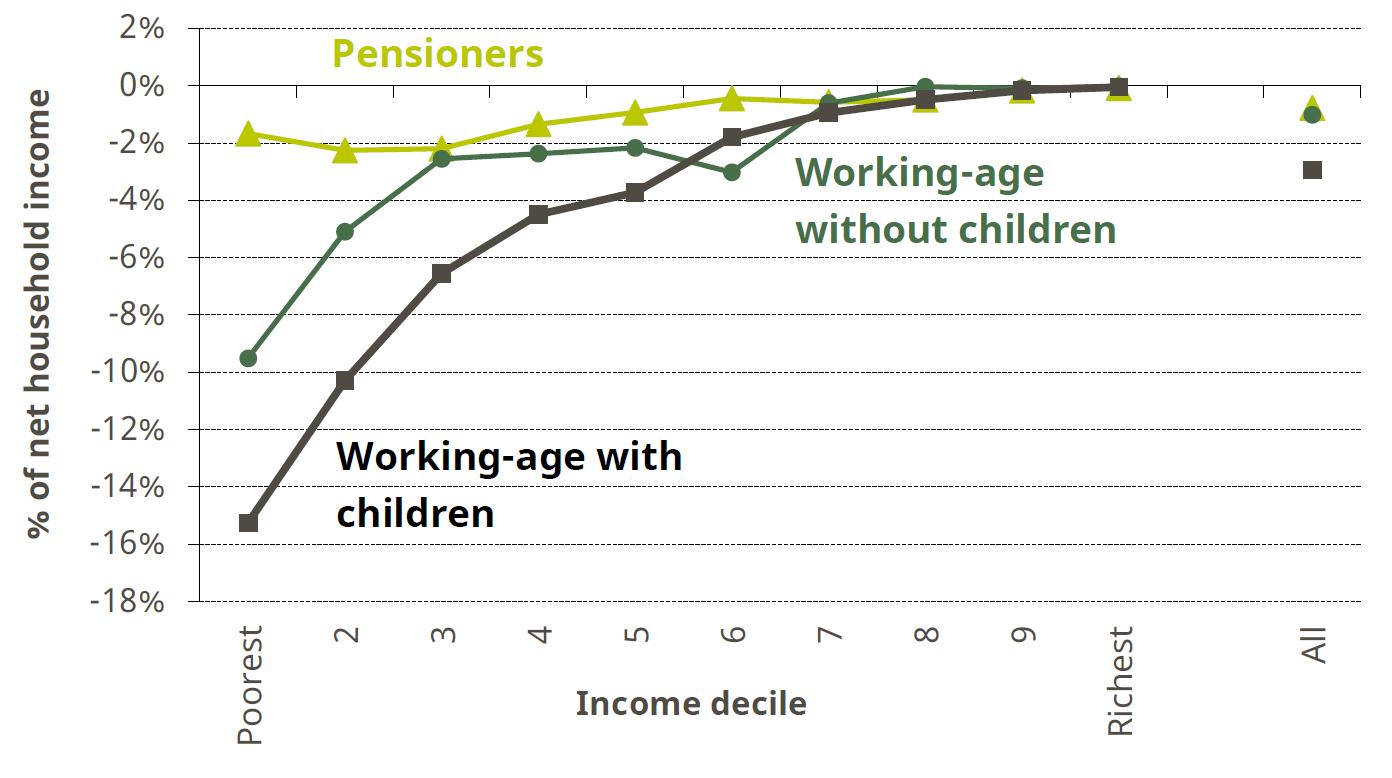

Social security spending (spending on benefits, tax credits and state pensions) is the biggest single component of government spending. The design and generosity of the system affects the incomes and work incentives of millions of households. Since 2010, there have been a number of cuts to the generosity of working-age benefits, while pensioners have been mostly protected and have benefited from the 'triple lock' on the state pension. Government plans for future cuts would significantly reduce the incomes of low-income working-age households, particularly those with children (as shown in the figure below). The next government will face important choices about how much to spend on benefits and the state pension, and where that money should go. In the run-up to the 2017 general election we will be publishing analysis of benefit and pension changes that parties are proposing.

Long-run impact of planned tax and benefit reforms by income decile and household type

Note: Income decile groups are derived by dividing all households into 10 equal-sized groups according to net income adjusted for household size using the McClements equivalence scale. Assumes full take-up of means-tested benefits and tax credits, and that all planned changes are fully in place.

Source: Figure 3, The impact of tax and benefit reforms on household incomes, 27 April 2017

IFS election 2017 publications

Briefing notes

Andrew Hood and Tom Waters, The impact of tax and benefit reforms on household incomes, 27 April 2017

Observations

Andrew Hood, Robert Joyce and Tom Waters, Income tax and benefits: the Liberal Democrats and Labour compared, 17 May 2017

Andrew Hood, A 'double lock' on the state pension would still be a bad idea, 27 April 2017

Useful resources

Budget and Green Budget Analysis

Andrew Hood, Personal tax and benefit changes, IFS Budget briefing 2017 (presentation), 9 March 2017

Carl Emmerson, Robert Joyce and David Sturrock, Working age incapacity and disability benefits, Chapter 6 of 2017 IFS Green Budget, Carl Emmerson, Paul Johnson and Robert Joyce (eds.), February 2017

James Browne, Andrew Hood and Robert Joyce, The (changing) effects of universal credit, Chapter 10 of 2016 IFS Green Budget, Carl Emmerson, Paul Johnson and Robert Joyce (eds.), February 2016

Andrew Hood, Benefit and tax credit changes, IFS Autumn Statement analysis 2015 (presentation), 26 November 2015

Andrew Hood, Benefit changes and distributional analysis, IFS Summer Budget analysis 2015 (presentation), 17 June 2015

Observations

Andrew Hood, Agnes Norris Keiller and Tom Waters, Significant cuts to two parts of the benefit system to be phased in from next week, 30 March 2017

Carl Emmerson, Would you rather? Further increases in the state pension age v abandoning the triple lock, 27 February 2017

Andrew Hood and Robert Joyce, A tighter benefit cap, 6 November 2016

Newspaper articles

Carl Emmerson, George Osborne's Budget?, The Mirror, 8 March 2017

Paul Johnson, Mental health problems and lack of education locks people out of work, The Times, 20 February 2017