Earnings, employment and productivity

Earnings, employment and productivity

Analysis for our election briefing note on the the labour market in early 2017 shows that the employment rate is flat and that real earnings growth has stalled.

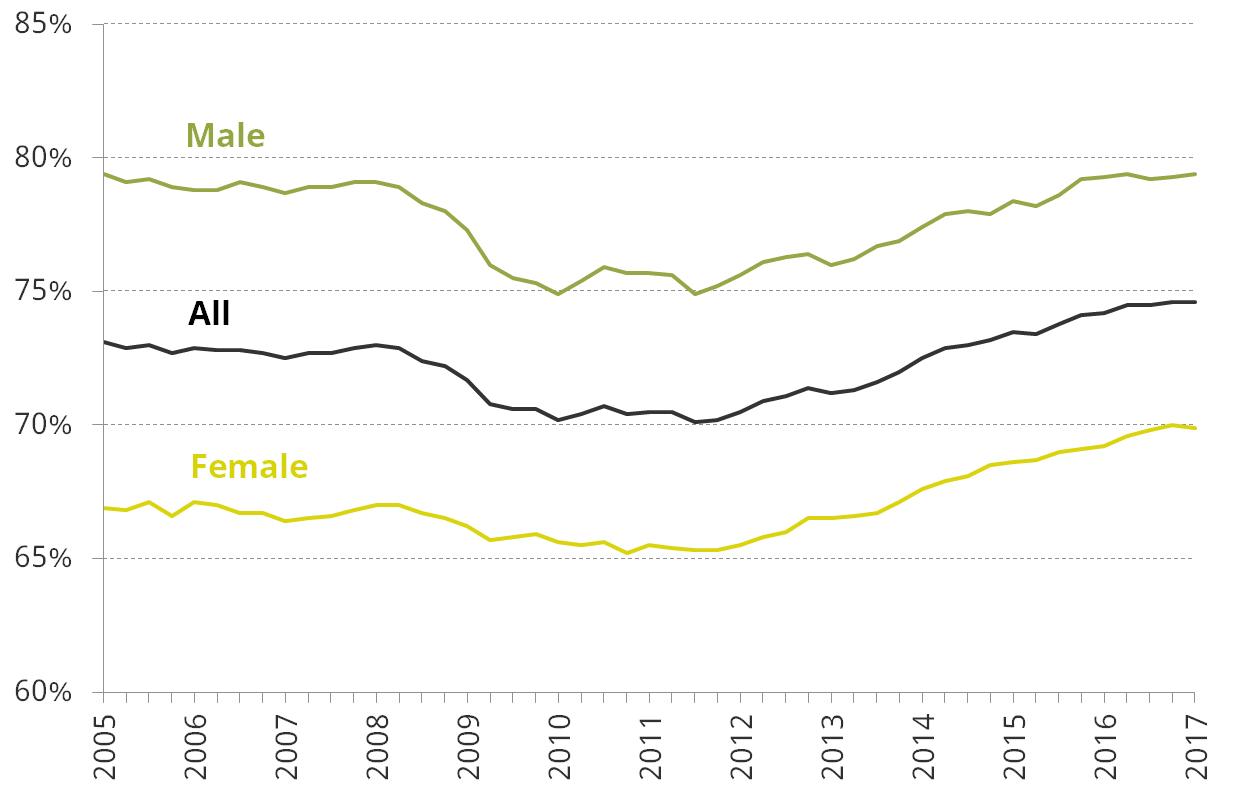

Employment rate (aged 16–64)

Note: 2017Q1 data point contains data for the three months ending in February 2017.

Source: ONS series LF24, MGSV and LF25.

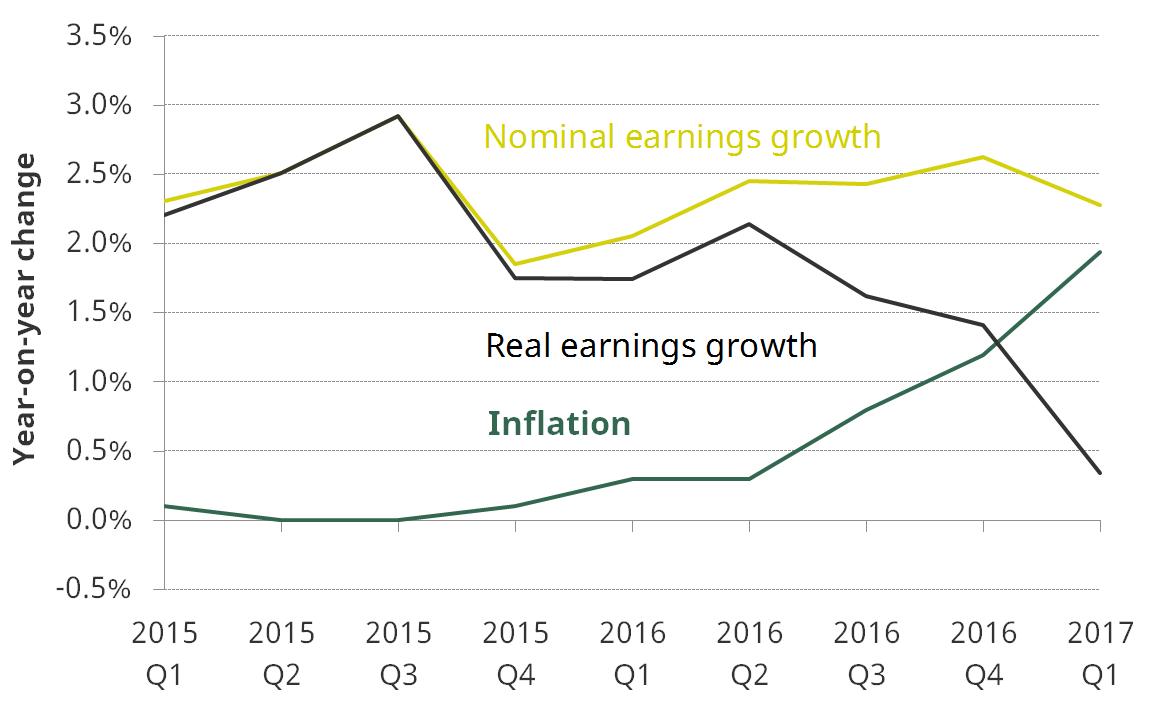

Annual nominal mean earnings growth, inflation and real mean earnings growth since 2015Q1

Note: Inflation measured using the Consumer Prices Index. 2017Q1 refers to the three months December 2016 to February 2017. Growth in prices and earnings are calculated compared with the same three months a year earlier.

Source: Authors’ calculations using ONS Average Weekly Earnings series.

Key findings

- The remarkable growth in employment since 2012 means the current employment rate is at a record high of 75%. However, it has levelled off in recent months and is not forecast to rise further.

- There is no evidence that recent employment growth has been disproportionately driven by jobs in low-skilled occupations. Measures of ‘under-employment’ (workers who want to work more hours) are still higher than in 2008, but have fallen back since 2012.

- Although the number of non-UK-born workers has increased faster than the number of UK-born workers since 2008, the employment rate of UK-born individuals is at a record high.

- After adjusting for inflation, average earnings of employees are still substantially below pre-recession levels, and are currently being squeezed by rising household inflation (linked in large part to falls in sterling). Central forecasts from the Office for Budget Responsibility (OBR) imply average earnings will still be lower than their 2007–08 level in 2021‒22. This is despite an extraordinary increase in the education levels of the workforce: 35% are now graduates compared with 25% in 2008.

- Men and younger workers have seen larger falls in average earnings than women and older workers since 2008. Low-earning workers, boosted by recent large increases in minimum wage rates, have seen stronger pay growth since 2008 than higher-paid workers.

- With unemployment having fallen to below 5%, further increases in employment will be harder to achieve. A key future challenge is pay growth: it will continue to disappoint unless poor productivity growth can be redressed. It is hard to overstate how important this is to increasing living standards in the long run.

IFS election 2017 publications

Briefing Notes

Jonathan Cribb, Public sector pay in the next parliament, 19 May 2017

Stuart Adam, Andrew Hood, Robert Joyce and David Phillips, Labour’s proposed income tax rises for high-income individuals, 16 May 2017

Jonathan Cribb, Robert Joyce, Agnes Norris Keiller, The UK labour market: where do we stand now?, 28 April 2017

Observation

Jonathan Cribb, Robert Joyce, Agnes Norris Keiller, Minimum wages in the next parliament, 11 May 2017

Useful resources

Reports and briefing notes

Jonathan Cribb, Andrew Hood, Robert Joyce and Agnes Norris Keiller, Income growth in 2015–16 modest but widespread, leaving inequality and poverty roughly unchanged, 16 March 2017

Stuart Adam, Helen Miller and Thomas Pope, Tax, legal form and the gig economy, in The 2017 IFS Green Budget, Carl Emmerson, Paul Johnson and Robert Joyce (eds.), 2 February 2017

Neil Amin-Smith, Jonathan Cribb and Luke Sibieta, Reforms to apprenticeship funding in England, in The 2017 IFS Green Budget, Carl Emmerson, Paul Johnson and Robert Joyce (eds.), 2 February 2017

Chris Belfield, Richard Blundell, Jonathan Cribb , Andrew Hood , Robert Joyce and Agnes Norris Keiller, Two decades of income inequality in Britain: the role of wages, household earnings and redistribution, report summary, 13 January 2017

Presentations

Jonathan Cribb, The UK labour market and labour market policies, presentation at the Department for Business, Energy and Industrial Strategy, 31 March 2017

Helen Miller, Should different ways of working be taxed differently?, CIOT/IFS debate, 21 March 2017

Jonathan Cribb, Earnings and the labour market, IFS post-Budget briefing, 9 March 2017

Helen Miller, Business taxes, IFS post-Budget briefing, 9 March 2017