Public finances and public spending

Public finances and public spending

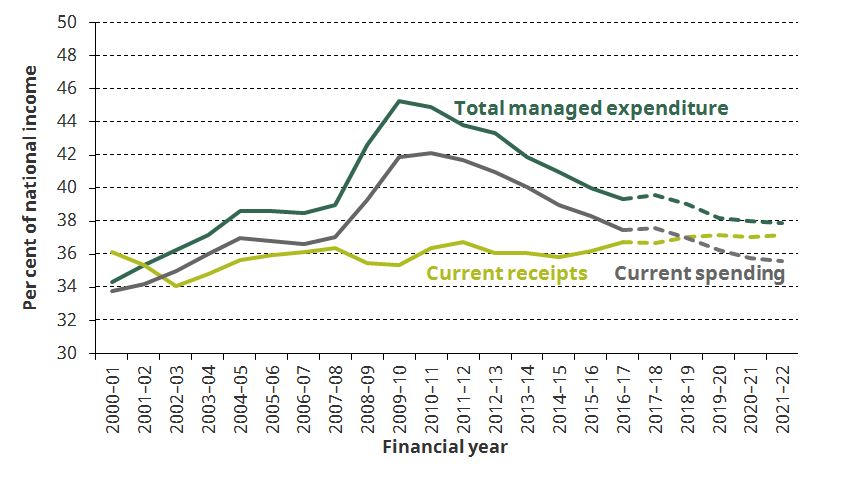

The financial crisis and associated recession led to tax revenues falling as a share of national income and, to a greater extent, public spending rising as a share of national income. The extent to which spending exceeds revenues is the deficit, which in 2009–10 peaked at its largest level as a share of national income since at least the Second World War.

Since then the deficit has been reduced. In part this has been due to increases in tax revenues as a share of national income. But more significant have been the reductions in total spending. As a result the deficit in 2016–17 was at a similar level, relative to the size of the economy, to that recorded prior to the crisis in 2007–08, with both spending and receipts both slightly above their levels of a decade ago.

The latest forecasts imply revenues continuing to rise as a share of national income so that they reach their highest level since 1986–87. Current spending – that is public spending excluding investment spending – is forecast to continue to be reduced as a share of national income. If correct this implies revenues slightly exceeding current spending in 2018–19 (implying a current budget surplus), which would be the first time this had been achieved since 2001–02.

Investment spending (which represents the difference between total spending and current spending in the figure) is forecast to increase as a share of national income over the next five years, having been cut significantly during the first half of the 2010s.

By the end of the forecast horizon in 2021–22 total spending is forecast to be still running ahead of total receipts by 0.7% of national income (or £15 billion in 2017–18 terms). This suggests that further tax rises or spending cuts would need to be implemented if the deficit is to be eliminated by the end of the next parliament.

Tax and spend as a share of national income since the turn of the century

Note: Official forecasts adjusted for the subsequent announcement that the planned increase in Class IV National Insurance contributions would not go ahead.

Source: Office for Budget Responsibility, Public Finances Databank, 31 March 2017 (http://budgetresponsibility.org.uk/data/); Office for Budget Responsibility, Policy measures database, 8 March 2017 (http://budgetresponsibility.org.uk/download/policy-measures-database/); author’s calculations.

IFS election 2017 publications

Briefing note

Jonathan Cribb, Public sector pay in the next parliament, 19 May 2017

Rowena Crawford and Carl Emmerson, Inevitable trade-offs ahead: long-run public spending pressures, 12 May 2017

Carl Emmerson, Two parliaments of pain: the UK public finances 2010 to 2017, 2 May 2017

Observation

Andrew Hood, A 'double lock' on the state pension would still be a bad idea, 27 April 2017

Useful resources

Budget and Green Budget analysis

A presentation given at the IFS Budget briefing 2017 updated our outlook for the public finances in light of new OBR data and the Chancellor’s announcements

Carl Emmerson and Thomas Pope, Challenges for the UK public finances, The 2017 IFS Green Budget, Carl Emmerson, Paul Johnson and Robert Joyce (eds.), February 2017

Observation

Thomas Pope, IFS analysis of today’s public finance figures, 21 February 2017

Newspaper articles

Paul Johnson, Labour’s manifesto spending plans are impossible to cost, The Times, 12 May 2017

Paul Johnson, So many choices – but none is easy, The Times, 20 April 2017

Carl Emmerson, George Osborne's Budget?, The Mirror, 8 March 2017

Paul Johnson, Chancellors of all colours realise that there is safety in numbers, The Times, 07 March 2017

Video explainers

Carl Emmerson, What's happening with the government's finances?, March 2017

Other

OBR databank contains long-run public finances data.

IFS Fiscal Facts tables contain links to useful facts and figures about the UK public finances, public spending and taxation